New Zealand: Per Capita Climate Debt $2,752 (Ranked 21) – Fossil CO2 Emissions

In 2024, New Zealand is responsible for 0.18% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

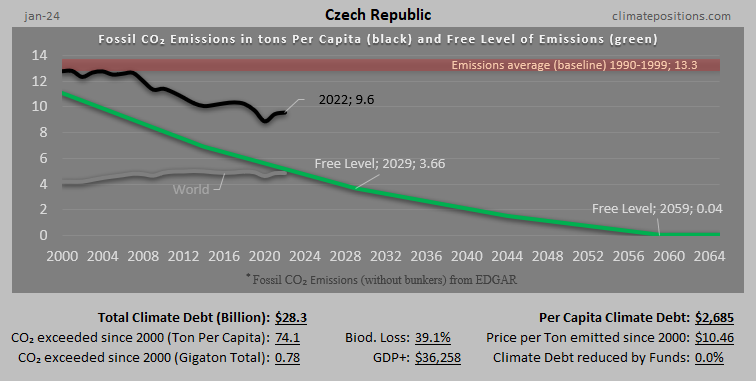

Czech Republic: Per Capita Climate Debt $2,685 (Ranked 22) – Fossil CO2 Emissions

In 2024, Czech Republic is responsible for 0.36% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

Germany: Per Capita Climate Debt $2,590 (Ranked 23) – Fossil CO2 Emissions

In 2024, Germany is responsible for 2.78% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

Japan: Per Capita Climate Debt $2,527 (Ranked 24) – Fossil CO2 Emissions

In 2024, Japan is responsible for 4.04% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

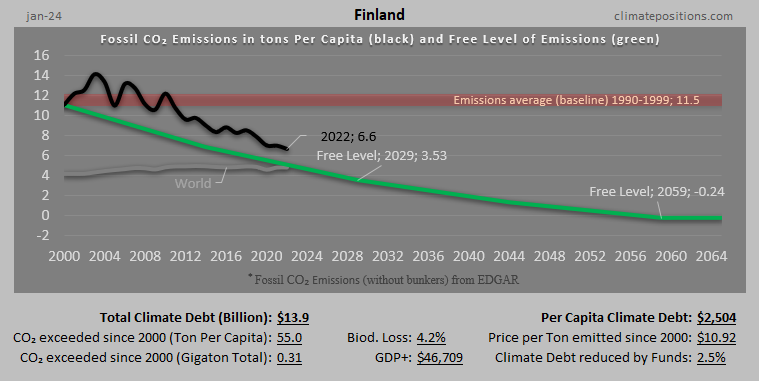

Finland: Per Capita Climate Debt $2,504 (Ranked 25) – Fossil CO2 Emissions

In 2024, Finland is responsible for 0.18% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

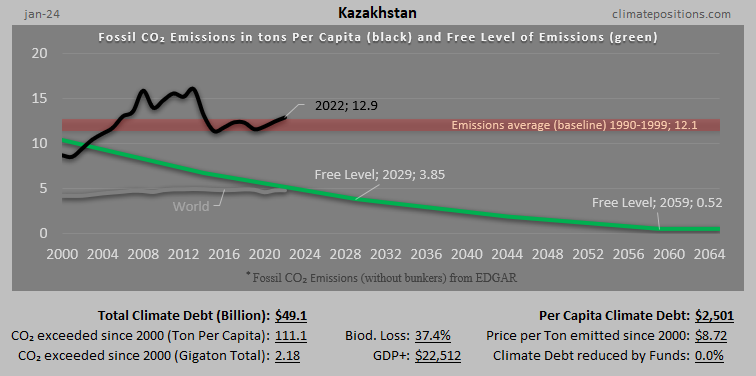

Kazakhstan: Per Capita Climate Debt $2,501 (Ranked 26) – Fossil CO2 Emissions

In 2024, Kazakhstan is responsible for 0.63% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

Estonia: Per Capita Climate Debt $2,417 (Ranked 27) – Fossil CO2 Emissions

In 2024, Estonia is responsible for 0.042% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

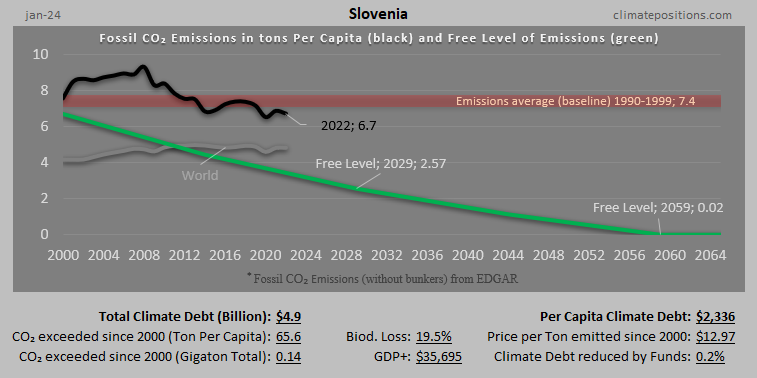

Slovenia: Per Capita Climate Debt $2,336 (Ranked 28) – Fossil CO2 Emissions

In 2024, Slovenia is responsible for 0.063% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

Malaysia: Per Capita Climate Debt $2,145 (Ranked 29) – Fossil CO2 Emissions

In 2024, Malaysia is responsible for 0.93% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

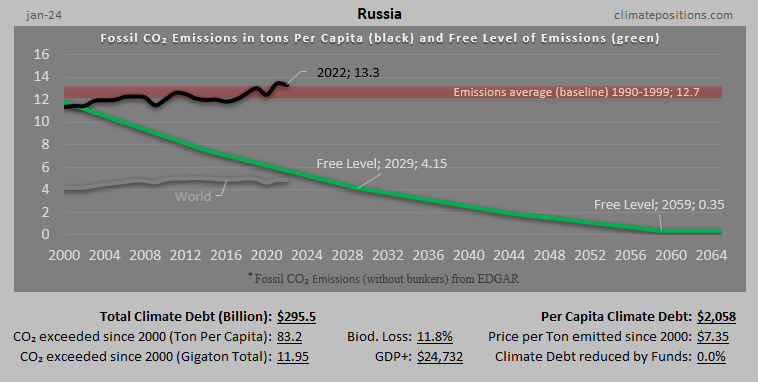

Russia: Per Capita Climate Debt $2,058 (Ranked 30) – Fossil CO2 Emissions

In 2024, Russia is responsible for 3.78% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

Spain: Per Capita Climate Debt $1,972 (Ranked 31) – Fossil CO2 Emissions

In 2024, Spain is responsible for 1.20% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

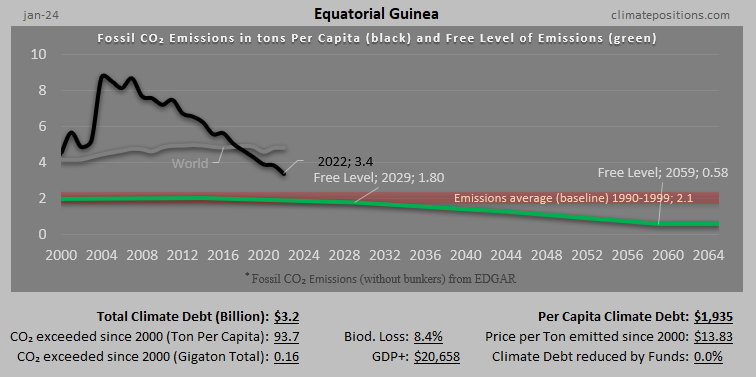

Equatorial Guinea: Per Capita Climate Debt $1,935 (Ranked 32) – Fossil CO2 Emissions

In 2024, Equatorial Guinea is responsible for 0.041% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

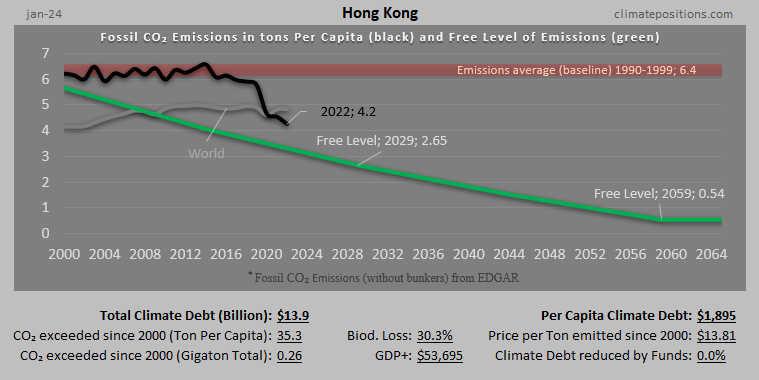

Hong Kong: Per Capita Climate Debt $1,895 (Ranked 33) – Fossil CO2 Emissions

In 2024, Hong Kong is responsible for 0.18% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

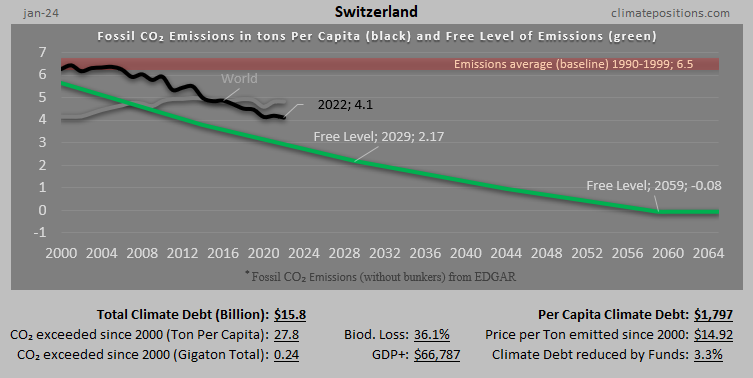

Switzerland: Per Capita Climate Debt $1,797 (Ranked 34) – Fossil CO2 Emissions

In 2024, Switzerland is responsible for 0.20% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

Italy: Per Capita Climate Debt $1,747 (Ranked 35) – Fossil CO2 Emissions

In 2024, Italy is responsible for 1.31% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

France: Per Capita Climate Debt $1,707 (Ranked 36) – Fossil CO2 Emissions

In 2024, France is responsible for 1.48% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

United Kingdom: Per Capita Climate Debt $1,584 (Ranked 37) – Fossil CO2 Emissions

In 2024, United Kingdom is responsible for 1.36% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

Libya: Per Capita Climate Debt $1,558 (Ranked 38) – Fossil CO2 Emissions

In 2024, Libya is responsible for 0.14% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

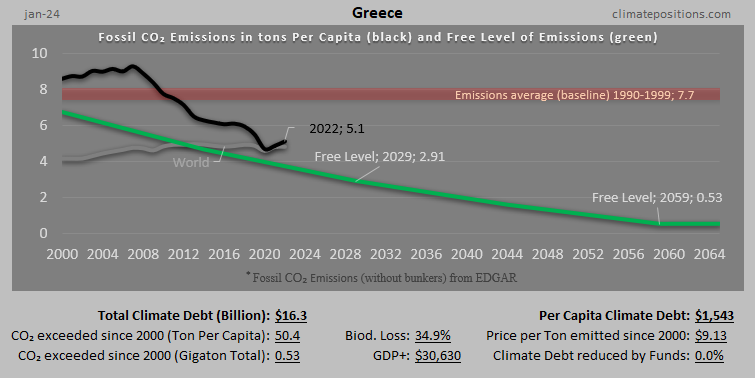

Greece: Per Capita Climate Debt $1,543 (Ranked 39) – Fossil CO2 Emissions

In 2024, Greece is responsible for 0.21% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.

Turkmenistan: Per Capita Climate Debt $1,507 (Ranked 40) – Fossil CO2 Emissions

In 2024, Turkmenistan is responsible for 0.12% of the Global Climate Debt accumulated since 2000. Below are some key figures in the calculations.